Every Little Thing You Should Find Out About Merchant Accounts

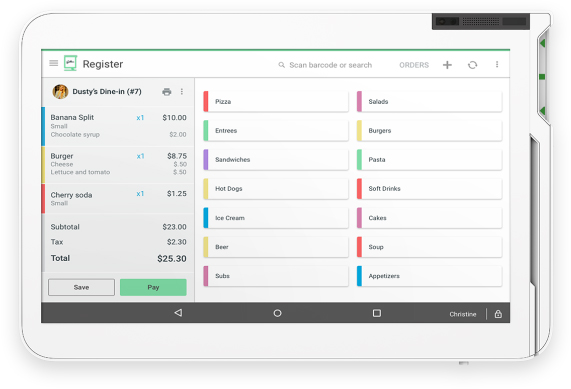

Unlike typical vendor accounts that need an application as well as approval process, anybody can register for Square and receive the same processing prices. Square's low startup prices and affordable handling prices, smooth interface, as well as progressed POS features make it the very best cost-free vendor represent local business. A seller should establish a seller account with a seller acquiring bank if they plan to supply electronic repayment alternatives for their items or solutions. Merchant getting banks play a crucial duty in the digital repayment procedure as well as are crucial for reliable handling and negotiation of repayment deals. A merchant account is an account that allows your sellers to process on the internet card settlements. When your consumers pay, the funds will certainly be deposited right into your retail seller account.

Contrasting TC Bancshares (NASDAQ:TCBC) and Eastern Bankshares (NASDAQ:EBC) - Defense World

Contrasting TC Bancshares (NASDAQ:TCBC) and Eastern Bankshares (NASDAQ:EBC).

Posted: Mon, 08 Aug 2022 05:32:06 GMT [source]

These fees can range from 0.5% to 5.0% of the transaction quantity plus $0.20 to $0.30 per transaction. Merchant account partnerships are essential for on the internet businesses. These account partnerships involve included costs which some brick and mortar facilities might select not to pay by accepting just cash for deposits in a common service bank account. The merchant account provider will likely accept your application if your business history and purchase type make you a low-risk choice. Riskier business may still be accepted, but with extra and also greater costs.

Advantages Of A Seller Collector Account

Ask the consumer to supply you with a http://smallbusinessliving005.yousher.com/exactly-how-to-assume-like-an-exponential-entrepreneur-and-also-grow-your-organization-10x-conveniently fax or photocopy of their passport or bank card. If you have any kind of serious uncertainties after that constantly turn to an alternative technique of payment such as a financial institution transfer or cheque. Although you might have http://speculatorrealm159.theglensecret.com/what-do-business-owners-contribute-to-culture several bank accounts connected to your merchant account, you might only have one checking account per settlement money.

What is a merchant payment?

"Merchant" is a term used by payment processors to refer to their customers. Customers, or merchants, are businesses that accept credit card payments from their clients in-person, online, or over the phone.

You also do not need to bother with things like long-lasting agreements and enormous discontinuation fees. If you're running an offline store, then you'll need to establish some terminals and POS systems. Usually, vendor company will have specialists offered to help you with this. Selecting a vendor account isn't the like picking a site building contractor or an email provider. You pick your vendor account solutions, and the business you choose needs to be comfy accepting you in return.

Add Regards To Solution And Also Refund Plans

Virtually every service seeking to set-up a Seller Account will be considered as high danger. Your company ought to enable you to re-negotiate the terms when you have acquired a trading background. Popular solutions like PayPal, Venmo and also others permit users to accept online card settlements without the need for any specialized gadgets. With that said stated, vendors like Square use mobile card readers at a very low cost or perhaps free depending on your service bundle. Accepting charge card repayments has ended up being nearly a need to do business. But the possibility of drawing out cash from a piece of plastic in your client's budget-- or a string of ones and also absolutely nos in their phone-- is frightening.

How much does a merchant account cost?

Most providers will charge you a monthly, ongoing fee for their merchant account services, as well. This will typically be a flat fee of $10 to $30 that could be called a statement fee, an account fee, or simply a monthly fee.

Here, we compensated systems with clear pricing versions that are easy to budget for as well as use with stable/reliable handling and intuitive interfaces. Because repayment processing directly impacts a company' cash flow and monetary wellness, we additionally considered the general popularity and also online reputation of each firm. Ultimately, we awarded points to systems that integrate with prominent small business software program such as audit devices, POS systems, as well as ecommerce platforms.

As Discussed Over, A Settlement Entrance Is Just That An On The Internet Deal Requires To Pass It Through Prior To It's Finalized

These devices procedure cash as well as credit card repayments and also send out the data to a centralised drive that is just obtainable offline. Once a year, the business proprietor by hand updates the entire system to synchronise the current improvements. Some service providers provide seller account services priced on an "interchange plus" basis.

What Are Payment Service Providers? - NerdWallet

What Are Payment Service Providers?.

Posted: Wed, 21 Apr 2021 23:04:13 GMT [source]