Can You Take Card Payments Without A Vendor Account?

It groups purchases made and also sends them to your account in one down payment. When processing lots of transactions a day, this will make your accountancy process easier. A merchant account holds customer down payments when they have acquired something from you. The globe of online repayments is a large and also commonly flustering one.

Companies that have an above ordinary quantity of time from when they take the settlement to when the order is satisfied are considered as higher risk. When the called for pocketbooks are real-time you will certainly obtain accessibility to manage the Control panel which contains purchase information, turn over reports, analytics, as well as thorough tools for fixing disputes. Unlimint will certainly perform smooth AML & KYC treatments upon getting of merchant application. After you complete the application, we will assess your needs and also regional characteristics to use the most effective remedies for your business.

Cost-free 1st Month Of Handling

The newer six-tier rates, including additional tiers covering debit, service, or global cards is obtaining in appeal. In three-tier pricing, the seller account service provider groups the purchases right into three groups and appoints a price to every tier based upon a requirement established for each and every rate. Think of your seller services provider as a facilitator between bank card companies as well as your bank. The seller services provider will streamline your charge payments and also client charges so your financial resources stay organized for less complicated bookkeeping. Credit score as well as debit cards have a little code on the signature strip that can be used as extra security when making payments.

Who assigns merchant codes?

A Merchant Category Code is a four-digit number that identifies the type of products or services the merchant provides. They were mandated by the Internal Revenue Service in 2004 to facilitate tax reporting. Currently, the MCC guidelines are maintained by the International http://smallbusinessliving005.yousher.com/exactly-how-to-assume-like-an-exponential-entrepreneur-and-also-grow-your-organization-10x-conveniently Organization for Standardization.

If you are a little, brick-and-mortar service that primarily handles cash, a conventional POS configuration could be one of the most cost-effective alternative. Your account may be frozen or terminated without alerting if questionable purchases are spotted. A merchant does not settle their day-to-day batch within the allotted time frame, generally previous 48 hours from the time of permission.

Offer The Localized Experience Customers Anticipate

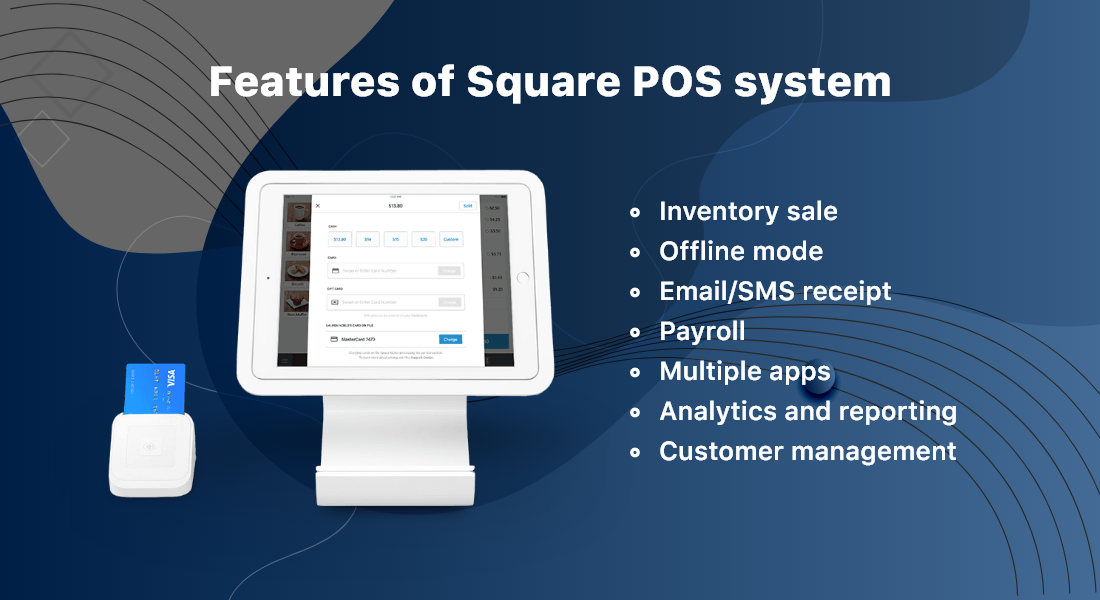

Almost every business wanting to set-up a Merchant Account will certainly be deemed as high risk. Your carrier must allow you to re-negotiate the terms once you have gotten a trading background. Popular solutions like PayPal, Venmo and others enable individuals to approve on the internet card repayments without the demand for any specialized gadgets. With that said stated, vendors like Square use mobile card visitors at an extremely affordable and even free depending upon your solution package. Accepting charge card payments has actually become nearly a requirement to do organization. However the possibility of removing cash from a piece of plastic in your client's budget-- or a string of ones and nos in their phone-- is intimidating.

How much does a merchant account cost?

Most providers will charge you a monthly, ongoing fee for their merchant account services, as well. This will typically be a flat fee http://speculatorrealm159.theglensecret.com/what-do-business-owners-contribute-to-culture of $10 to $30 that could be called a statement fee, an account fee, or simply a monthly fee.

Here, we compensated systems with transparent prices versions that are simple to allocate and make use of with stable/reliable handling and user-friendly interfaces. Because settlement processing directly impacts a service' cash flow and also economic wellness, we also considered the total popularity and track record of each firm. Lastly, we awarded points to systems that integrate with preferred small business software such as audit tools, POS systems, and also ecommerce platforms.

A vendor account is an unique sort of savings account that holds your cash after a charge card deal is run and also while the credit card network processes the deal. Afterwards, the cash is transferred into your organization savings account. If you're just establishing a company, it can be complex identifying exactly how to refine charge card settlements, deposit money, as well as pay your expenses.

What Are Payment Service Providers? - NerdWallet

What Are Payment Service Providers?.

Posted: Wed, 21 Apr 2021 23:04:13 GMT [source]